Carbon tax: everything you need to know

Definition of carbon tax

The carbon tax is an environmental tax based on the polluter-pays principle, applied to co2 emissions resulting from the combustion of fossil fuels (oil, gas, coal). Its goal is to encourage businesses and consumers to reduce their emissions by integrating the cost of carbon into products and services. Unlike the emissions trading system, where a global cap is set and emission rights are traded, the carbon tax imposes a fixed cost per ton of co2 emitted.

Who is behind the carbon tax?

The carbon tax originates from several studies by environmental economists who developed the polluter-pays concept to internalize the costs associated with co₂ emissions. The idea was popularized in the 1990s, notably thanks to the recommendations of the IPCC (intergovernmental panel on climate change) and commitments made at international climate summits.

The first country to introduce a carbon tax was finland in 1990, followed by other european nations such as sweden and norway. Since then, several governments have adopted this measure to encourage the energy transition and finance ecological projects. Today, institutions such as the european union, the world bank, and the OECD are encouraging countries to strengthen their carbon taxes to accelerate the fight against climate change.

Objectives of the carbon tax

The carbon tax has several objectives to combat climate change and accelerate the transition to a low-carbon economy:

- Reducing co₂ emissions: by imposing a cost on emissions, the carbon tax makes companies and individuals responsible for their environmental impact. By making the use of fossil fuels financially restrictive, it encourages the adoption of more ecological alternatives and the review of production and consumption models.

- Incentivizing the use of renewable energy: by increasing the price of fossil fuels, the carbon tax promotes the competitiveness of renewable energy sources such as solar, wind and hydroelectricity. It thus encourages investment in these sectors and accelerates the adoption of more sustainable energy solutions.

- Improving energy efficiency: the rising cost of fossil fuels is forcing businesses and households to reduce their energy consumption to limit their bills. Improving energy efficiency can involve constructing high-energy-performance buildings, optimizing industrial processes, or modernizing transportation and heating systems.

- Stimulating technological innovation: by imposing a financial constraint on emissions, the carbon tax encourages companies to invest in research and development of clean technologies. It thus promotes the emergence of innovative solutions such as biofuels, carbon capture and storage, as well as new low-carbon production methods.

- Towards more responsible consumption: by integrating the environmental cost into the prices of goods and services, the carbon tax makes consumers aware of the climate impacts of their choices. This can lead to changes in habits, such as purchasing less energy-intensive products, using public transport or reducing energy waste in everyday life.

- Financing the ecological transition: the revenue generated by the carbon tax can be used to finance public policies in favor of the climate. They can be used to support the most vulnerable households in the face of rising energy prices, subsidize the adoption of low-carbon solutions or invest in ecological infrastructure.

Which sectors are most affected by the carbon tax?

The carbon tax particularly impacts sectors that rely heavily on fossil fuels and generate significant co₂ emissions.

Heavy industries, such as steel, cement, and chemicals, are among the most affected. These sectors use energy-intensive processes and still have few viable large-scale technological alternatives. A rise in the cost of carbon therefore represents a major challenge to their competitiveness, particularly when compared to international competitors not subject to such a tax.

Transportation is also significantly affected by this tax. Road transport is directly affected by rising fuel prices, which affects logistics costs and the price of goods. Aviation and maritime, although long exempt from certain regulations, are beginning to be subject to carbon tax mechanisms, encouraging these industries to invest in alternatives such as biofuels or partial electrification.

Finally, the energy sector and agriculture are also impacted by the carbon tax. Electricity production from coal or gas is becoming more expensive, favoring the growth of renewable energies. In agriculture, carbon taxes influence the use of fertilizers and product transportation, increasing costs for farmers and consumers.

Is the carbon tax really effective?

The effectiveness of carbon taxes varies depending on the country and how they are implemented. Several studies show that when properly designed, they contribute to a significant reduction in co₂ emissions. In sweden, where a carbon tax has been in place since 1991, emissions fell by 27% between 1990 and 2018, while the economy continued to grow. In canada, the gradual introduction of a carbon tax has led to a reduction in emissions in some provinces.

Indeed, the success of a carbon tax depends on several key factors. Its price must be high enough to incentivize change, while being gradual to avoid an economic shock. Furthermore, revenues must be reinvested in the energy transition and used to support the most vulnerable households and industries. Finally, it must be accompanied by viable alternatives, such as energy efficiency incentives or subsidies for renewable energy. When properly implemented, the carbon tax becomes an effective lever for achieving climate objectives while supporting innovation and the green economy.

How carbon taxes work ?

A carbon tax is calculated based on the amount of co₂ emitted when fossil fuels are burned. The price of the carbon tax is set by governments and can vary from country to country. In europe, for example, some nations apply a specific rate per tonne of co₂ emitted, while others integrate the tax into broader systems, such as the carbon market. Its implementation requires strict regulation to avoid the risk of fraud and ensure fair application across different economic sectors.

Who should pay the carbon tax?

The carbon tax applies to all stakeholders responsible for the consumption and use of fossil fuels. it therefore concerns three main categories of contributors:

- Companies: industries that emit large amounts of co₂, such as the energy, transport, chemical and construction sectors, are the first to be affected by the payment of the carbon tax. They must integrate the cost of carbon into their expenses and adapt their models in order to reduce their carbon footprint. Some industries benefit from exemptions or adjustments to limit the impact of the carbon tax on their competitiveness.

- Households: consumers are indirectly affected by the carbon tax, in particular through the increase in the prices of energy, fuel or heating. Households that rely heavily on fossil fuels may therefore see their expenses increase, which can pose challenges for low-income households.

- Energy suppliers and distributors: the carbon tax is often applied upstream to companies that import, refine or distribute fossil fuels. They then pass these costs on to their end customers.

Where do carbon tax funds go?

The revenues generated by the carbon tax are intended to finance projects and policies related to the ecological and energy transition. However, their use varies depending on the country and government decisions.

In some countries, such as sweden and canada, the tax revenues are mainly reinvested in the development of renewable energies, improving energy efficiency and modernizing low-carbon infrastructure. This helps to accelerate the energy transition while reducing dependence on fossil fuels.

Other governments use part of the funds to offset the economic impact of the carbon tax on households and businesses, in particular through tax cuts, aid for the poorest households or subsidies for industries in transition.

In some cases, the revenues can also be included in the general state budget, without specific allocation to ecological projects. This practice raises criticism because it reduces the incentive effect of the tax for the energy transition.

To be effective, the use of carbon tax funds must be transparent and geared towards concrete actions. This ensures that the carbon tax plays its full role in the fight against climate change.

The carbon tax around the world

Which countries have carbon taxes?

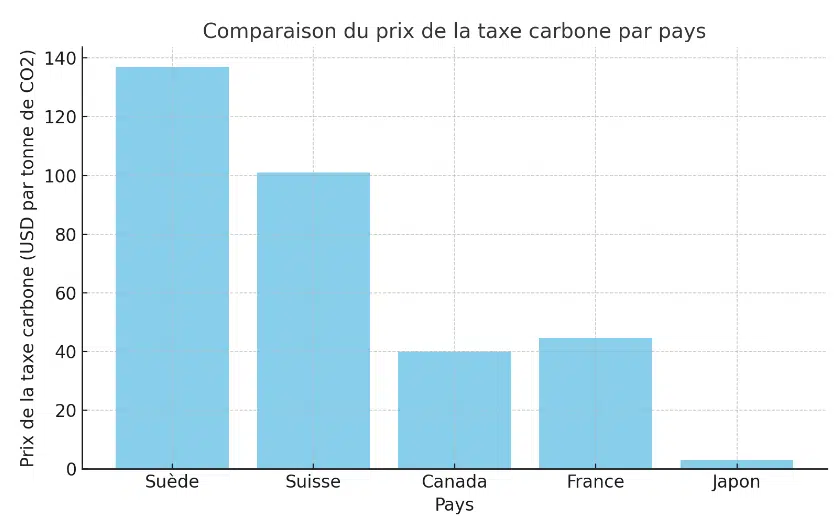

Many countries, including sweden, canada, and france, have adopted carbon taxes to encourage the reduction of co₂ emissions. Among the pioneers, sweden applies one of the highest taxes in the world, exceeding €110 per ton of co₂, which has led to a significant reduction in emissions. Canada has implemented a progressive tax system, with a carbon price that increases annually, varying by province.

In france, a carbon tax was introduced in 2014, but its increase was suspended in 2018 following social unrest. Other countries, such as switzerland, the united kingdom, germany, and japan, also apply carbon pricing, sometimes combined with emission quota mechanisms. However, the level and application of this tax vary depending on national policies, influencing its effectiveness on the energy transition.

Why do some countries refuse to implement a carbon tax?

Although carbon taxes have been adopted in several countries, others remain reluctant to implement them due to economic, social, and political considerations.

One of the main obstacles is the risk of loss of competitiveness. A carbon tax increases the production costs of local companies, particularly in high-emitting industries such as steel, chemicals, and transportation. Faced with international competition, some companies could choose to relocate their production to countries where carbon taxes do not exist, leading to “carbon leakage” and a loss of local jobs.

Governments also fear a negative social impact, particularly for low-income households. A rise in energy and fuel prices due to a carbon tax could exacerbate energy poverty and widen inequality, especially in countries where alternatives to fossil fuels are limited. Protest movements, such as the yellow vests in france, illustrate these tensions.

Thus, rather than introducing a carbon tax, some countries are favoring stricter environmental regulations, tax incentives for low-carbon businesses, or massive investments in green technologies. these alternatives encourage the energy transition without imposing a direct economic burden on consumers and industries.

Advantages and disadvantages of the carbon tax

Advantages of the carbon tax:

- Economic efficiency: the carbon tax is an effective lever to encourage the reduction of co₂ emissions by making low-carbon alternatives more financially attractive. By internalizing the cost of emissions, it encourages the optimization of energy consumption and the adoption of more sustainable practices.

- Revenue generation: revenue from the carbon tax can be reinvested in environmental projects, such as the development of renewable energies or the improvement of energy efficiency. These funds can also be used to finance aid for households and businesses to facilitate their transition to more sustainable solutions.

- Positive signal: the carbon tax sends a strong signal to businesses and consumers by highlighting the environmental cost of co₂ emissions. By integrating this data into purchasing and investment decisions, it promotes the development of less polluting technological and energy solutions.

- Stimulation of innovation: by increasing the cost of fossil fuels, the carbon tax also encourages industries to invest in research and development of low-carbon technologies. Thus, the carbon tax encourages the emergence of innovative solutions, such as alternative fuels, the electrification of transport or the improvement of industrial processes.

- Improving the competitiveness of renewable energies: by making fossil fuels more expensive, the carbon tax reduces the cost gap between conventional energies and renewable energies. This measure helps accelerate the deployment of green technologies by making them more competitive compared to polluting solutions.

- Preservation of natural resources: by encouraging a reduction in the consumption of fossil fuels, the carbon tax contributes to the preservation of limited natural resources, such as oil, gas and coal. This approach promotes more sustainable energy management and limits the negative impacts of their exploitation on ecosystems.

- Contribution to international climate commitments: many countries have made commitments to achieve carbon neutrality and comply with the paris agreement. The carbon tax helps align economic policies with these objectives by integrating a mechanism for the systematic reduction of co₂ emissions.

- Encouragement of green relocation: by taxing products and services with a high carbon footprint, the carbon tax can encourage some companies to relocate their production to countries where electricity is greener. This helps reduce the carbon footprint linked to transport and promotes the development of a cleaner industry at the local level.

- Job creation in sustainable sectors: the funds generated by the carbon tax can be reinvested in green industries, thus generating jobs in the renewable energy sector, energy renovation or new mobility.

Disadvantages of the carbon tax:

- Impact on purchasing power: the carbon tax leads to an increase in the price of fossil fuels, which directly affects consumers. Low-income households are particularly vulnerable, as they have less room to adapt their energy consumption or invest in more sustainable alternatives.

- Risk of relocation: companies that emit large amounts of co2 may choose to move their production to countries where carbon taxation is non-existent or less restrictive. This can lead to a loss of local jobs and reduce the climate effectiveness of the measure if emissions are simply transferred elsewhere, without any real overall reduction.

- Administrative complexity: the implementation of a carbon tax requires precise monitoring of emissions and rigorous management by tax administrations. Its application involves additional costs for companies, which must set up accounting and reporting tools that comply with regulatory requirements.

- Business competitiveness: companies subject to a carbon tax may see their production costs increase compared to foreign competitors not subject to this constraint. The carbon tax can thus create an economic disadvantage for local industries, particularly in energy-intensive sectors, and limit their capacity to invest in low-carbon solutions.

- Social acceptability and protests: the carbon tax can be poorly perceived by the population if it is considered unfair or too punitive. Without sufficient compensation, it can provoke strong social and political opposition, making its application difficult or even impossible to maintain in the long term.

- Variable effectiveness depending on the sector: not all sectors can reduce their co2 emissions at the same rate, or with the same solutions. Some, such as road transport or agriculture, have fewer viable alternatives in the short term, making the impact of the carbon tax more penalizing without guaranteeing a rapid energy transition.

Impact of the carbon tax on businesses and consumers

To adapt to the carbon tax, businesses must improve their energy efficiency, innovate in low-carbon technologies, and adjust their business models to incorporate more sustainable practices. This adaptation often leads to higher prices for goods and services for consumers, due to the additional costs associated with taxing co2 emissions. To limit the impact on households and vulnerable sectors, accompanying measures such as financial assistance, exemptions, or compensations are often put in place.

How does the carbon tax contribute to the energy transition?

The carbon tax plays a key role in the energy transition by encouraging businesses, industries, and consumers to review their energy consumption patterns. By increasing the cost of fossil fuels such as oil, gas, and coal, it encourages a gradual transition to cleaner and more sustainable energy sources. These price increases push companies to rethink their production processes, invest in less polluting technologies, and prioritize alternatives such as electrifying equipment or improving the energy efficiency of buildings and infrastructure.

The revenue generated by the carbon tax is an essential lever for financing green projects. These funds can be used to develop renewable energies, such as solar, wind, or biomass, but also to support initiatives aimed at modernizing energy grids and fostering innovation in low-carbon technologies. Some public policies also allocate a portion of the revenue to support households and businesses in their transition, in the form of subsidies for home insulation, assistance with the purchase of electric vehicles, or incentives for the use of public transportation.

By integrating the environmental cost of emissions into the economy, the carbon tax contributes to achieving national and international climate objectives, such as those set by the paris agreement. It not only reduces greenhouse gas emissions but also accelerates the adoption of more environmentally friendly production and consumption models, essential for limiting long-term global warming.

How does the carbon tax contribute to the energy transition?

The carbon tax contributes to the energy transition by generating revenue that can be reinvested in green projects, such as the development of renewable energy (solar, wind) and improving energy efficiency. By raising the cost of fossil fuels, it encourages businesses and consumers to change their behaviors, favoring low-carbon solutions. This tax helps achieve national and international climate goals, such as those of the paris agreement, by reducing greenhouse gas emissions and accelerating the energy transition toward a more sustainable model.

What are the challenges of the carbon tax?

The carbon tax raises several economic, social and environmental challenges, for businesses, consumers and governments.

From an environmental perspective, this tax aims to reduce greenhouse gas (GHG) emissions by making the use of fossil fuels more expensive. This practice encourages the development of renewable energies and the adoption of low-carbon solutions, thereby contributing to achieving international climate objectives, such as those of the paris agreement.

From an economic perspective, the carbon tax can promote innovation by encouraging businesses to invest in clean technologies and improve their energy efficiency. However, it can also pose a competitiveness problem for certain industries subject to strong international competition, if it results in higher costs than in other countries.

Finally, from a social perspective, the impact of the tax on household purchasing power is a major challenge. An increase in the price of energy can hit low-income households harder. To mitigate these effects, financial compensation mechanisms or targeted aid can be put in place to ensure a fair transition for all.

Alternatives to the carbon tax

While the carbon tax is an effective tool for reducing co₂ emissions, it is not the only possible solution. Other mechanisms exist to encourage the energy transition and limit the carbon footprint of businesses and individuals.

One of the main alternatives to the carbon tax is the emissions trading system, also known as the carbon market. This system is based on the principle of capping overall emissions, whereby companies receive or purchase co₂ allowances. If they exceed their limit, they must purchase additional emission allowances from other stakeholders who have reduced their own emissions. This system, used in particular in europe with the eu emissions trading system (ETS), encourages a gradual reduction in emissions while allowing companies some flexibility.

Another alternative is tax incentives, which rely on tax breaks or subsidies for stakeholders that invest in clean technologies. Rather than taxing polluters, this mechanism financially rewards those who adopt low-carbon solutions, such as renewable energy, energy efficiency, or the electrification of transportation.

Finally, stricter environmental regulations can also replace carbon taxes. For example, some governments impose mandatory standards, such as the gradual banning of internal combustion engines or emission thresholds for industries. These regulations directly force companies to adapt without resorting to carbon pricing.

Each alternative has advantages and limitations, and in many cases, a combination of these approaches makes it possible to achieve climate objectives in a more efficient and balanced manner.

What future for the carbon tax?

The future of the carbon tax depends on its harmonization and effectiveness on a global scale. While some countries are strengthening their carbon taxes to accelerate the energy transition, others remain reluctant due to the economic and social impacts. International coordination is therefore essential to avoid competitiveness distortions and the risks of relocation of industries to countries without carbon taxation.

A change in the carbon tax with a better redistribution of funds, in particular with more aid to households and businesses to finance low-carbon solutions, is envisaged. In addition, the integration of new co₂ capture and storage technologies could complement this environmental taxation.

Finally, discussions are focusing on the establishment of a carbon adjustment mechanism at the borders to tax imports according to their carbon footprint, in order to guarantee a fair and efficient transition at the global level.